Ethereum(ETH) Merge Explained

The upcoming Ethereum merge has sparked excitement and debate in the crypto asset sector. Here is everything you need to know about the world’s largest blockchain upgrade event.

What is a merge?

Merging code is a process of version control where software developers integrate changes into a codebase. Developers start this process by branching out from a shared codebase. Once the changes are complete and tested, the edited branch is merged back into the main codebase. In this case, the codebase being merged is the proof-of-stake consensus layer of the Ethereum blockchain. For more information about code merging click here.

Proof-of-Work to Proof-of-Stake

Proof-of-Work (PoW) is a transaction validation mechanism used by Bitcoin, Ethereum, Dogecoin, Ethereum Classic and Litecoin to regulate the creation of blocks and the state of the blockchain. Whereas, proof-of-Stake (PoS) is an alternative consensus mechanism which delegates control of the network to the owners of tokens, such as Cardano or Solana. The ETH merge represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new PoS consensus layer, the Beacon Chain. This eliminates the need for energy-intensive PoW mining and instead secures the network using staked ETH.

It's important to note, the Beacon Chain was initially deployed separately from the Ethereum Mainnet. With all of Ethereum’s accounts, balances, smart contracts, and blockchain states, it continues to be secured by PoW, even though the Beacon Chain runs in parallel using PoS. The approaching merge event represents the joining of these two systems, where the ETH PoW is replaced permanently by PoS.

What’s the beef between PoW and PoS?

PoS is argued as an improvement over PoW because it does not require the same level of energy-intensive electricity consumption for blockchain validation. However, by dropping these features, PoS also loses some PoW benefits. PoS systems are arguably more vulnerable to centralization because control of the network is determined solely by capital, which could be more centralized than PoW mining participants, depending on the blockchain. In a PoS network worth R100 billion where 10% of tokens are staked, the R100 billion network can be taken over by any party able to allocate R10 billion. All the attackers would have to do is send R10 billion in tokens to a staking contract. This means PoS does not work well for new tokens. However, the ETH blockchain is highly decentralized with the second largest network distribution next to Bitcoin – hence it is the perfect candidate for a PoS transition.

In a PoW blockchain, computational power is required to execute an attack on the network. Attacking a network with R10 billion of security would require purchasing ASIC miners, acquiring space and energy contracts to mine at a larger scale than the entire network, and acquiring and deploying the labour to execute the attack. If such an attack were underway, the entire network would likely be made aware ahead of time by the immense demand for ASICs and electricity. Stated differently, a well-distributed PoW blockchain is ultimately more secure than a PoS blockchain, offering deeper encryption through higher electricity consumption and slower transaction speeds.

ETH vs. ETC

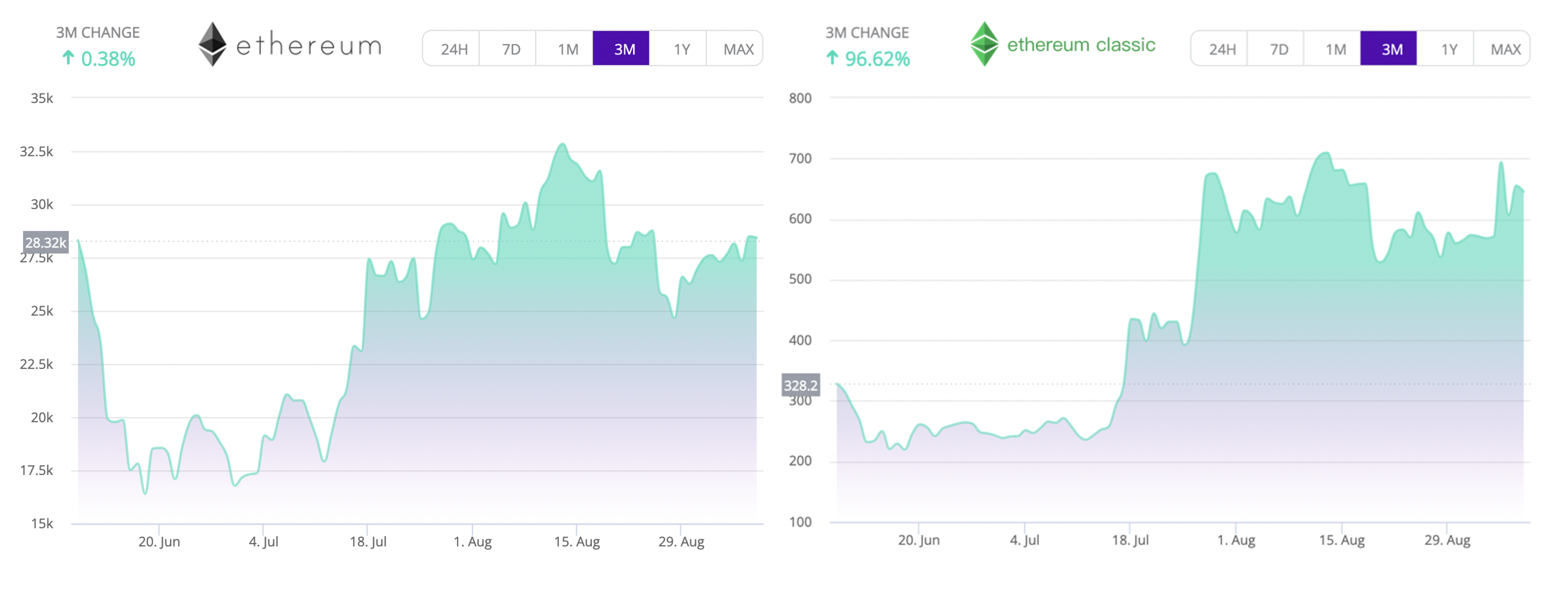

Proponents of PoW and smart contracts argue the ETH merge is a step in the wrong direction. This has caused a higher demand for the Ethereum Classic (ETC) token which is a historical fork of the PoW ETH blockchain. In the 3 months trailing the announcement of the ETH merge, ETC has grown 96.62%, whereas the price of ETH has remained relatively stable.

Will ETH trading on EasyCrypto be affected?

Both Ethereum and Ethereum Classic trading will not be affected on the EasyCrypto platform.

Will my ETH holdings be affected?

All Ethereum holders and their respective balances will not be affected by the merge.

When is the ETH merge?

The Merge is expected to land within Q3/Q4 2022. The ETH foundation developers are currently working toward a soft deadline of 19th September 2022. TBC.

What are the risks of the ETH merge?

The ETH merge event is being thoroughly tested but does still include an element of risk. It is the sole responsibility of the end customer to understand the risks involved with the Ethereum merge. EasyCrypto does not accept responsibility for any losses that may result from the Ethereum merge.

Can I skrrr skrrr my ETH?

No, you cannot skrrr skrrr your ETH.

Related posts

Browse tags

- All

- Easy Crypto (19)

- cryptocurrency (9)

- EC10 (4)

- Market News & Events (3)

- EC10 Bundle (2)

- Education (2)

- Volatility (2)

- BOME (1)

- BONK (1)

- BTC (1)

- Blockchain (1)

- Crypto Jargon (1)

- DOGE (1)

- Ethereum (1)

- FLOKI (1)

- How to fund my account (1)

- PEPE (1)

- SARS (1)

- SHIB (1)

- Solana (1)

- Terra (1)

- Tokenisation (1)

- ai (1)

- tax (1) View All View Less